These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. If you are proficient and comfortable using mathematics and computing figures, plus punctual, organized, and detail-oriented, it is not hard to learn how to be a bookkeeper. Of course, a background in accounting practices will help you ride out a learning curve as a new bookkeeper.

For example, KPMG offers employees up to 25 days of paid vacation time, telecommuting opportunities, and a robust health insurance package. If you are interested in becoming an accountant, it may be beneficial to your career to become a certified public accountant , which has its own exam. You must have a minimum of 150 postsecondary education hours, or what amounts to a bachelor’s degree in accounting, and an additional 30 hours of graduate work. Bookkeepers line up all the small pieces of a company’s financial records, and accountants view and arrange those pieces. Ebony Howard is a certified public accountant and a QuickBooks ProAdvisor tax expert. She has been in the accounting, audit, and tax profession for more than 13 years, working with individuals and a variety of companies in the health care, banking, and accounting industries.

But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. The Structured Query Language comprises several different data types that allow it to store different types of information… An example of an expense account is Salaries and Wages or Selling and Administrative expenses. Laura is a freelance writer specializing in ecommerce, lifestyle, and SMB content. As a small business owner, she is passionate about supporting other entrepreneurs, and sharing information that will help them thrive. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available.

Bookkeeping vs Accounting: Key Differences

The concepts covered range from account setup through year-end reporting, providing a comprehensive view of the bookkeeping process, and explaining how accounting and bookkeeping differ. We have only looked at books that allow you to be good at bookkeeping. This book will teach you how to start a bookkeeping business if you are interested. Readers have mentioned that this book is the most practical for self-employed bookkeepers. This book has outlined a system for building a bookkeeping practice from scratch.

Read more below to learn about bookkeeping, typical responsibilities, how to become a bookkeeper, and remote bookkeeping opportunities with Intuit working onQuickBooks Live in the U.S. 50 states. Then, kickstart your bookkeeping career by signing up for an Intuit Bookkeeping Certification. Being consistent, accurate, and minimizing errors are key characteristics that employers are seeking for this position.

Bookkeeping Basics and Initial Steps

https://1investing.in/ refer to the money used to run the business but aren’t related to products or services. For instance, one of the items under the expense account is salary or payroll expenses. Equity refers to the ownership of the business owners and investors in the company. In the Balance Sheet, the equity accounts cover all the claims they have over the company. QuickBooks Live Bookkeepercan help ensure that your business’s books close every month, and you’re primed for tax season. Our experts—CPAs and QuickBooks ProAdvisors—average 15 years of experience working with small businesses across industries.

” If you’re new to business, you may already have a million other things to worry about. Brushing up on your bookkeeping skills may seem like a task for another day. However, there are innumerable benefits to keeping accurate documentation and monitoring your spending and income. It is one of the methods you can use to determine the current worth of your inventory if you operate a retail business. This accounting method presumes that your most recent products will be the first to sell . If your inventory costs fluctuate between the first and last items, this bookkeeping method helps keep the most accurate records possible.

Which Accounting Jobs Are in Demand?

Bookkeepers are commonly responsible for recording journal entries and conducting bank reconciliations. A bookkeeper must be able to shift focus easily and catch tiny, hidden mistakes in a budget or invoice. They often bookkeepers work a few jobs for various clients if they work as a consultant. You can become a bookkeeper right out of high school if you prove you are good with numbers and have strong attention to detail.

Proper financial records make it easier for you to analyze the financial state of your firm and determine areas that need improvement. The maintenance of financial statements and books of accounts is a legal requirement under many acts. In the case of banks or companies or insurance companies, the acts that regulate them require such firms to maintain and keep financial records.

Freelance bench accountings can range from quick temporary projects to long-term employment. However, they may be less likely to offer training or educational opportunities. There are many opportunities to work in a salaried position from home to gain on-the-job training. The Intuit Tax and Bookkeeping Talent Community is a great place to find remote bookkeeping jobs and access training material. You can also find remote jobs on job board websites such as Indeed. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

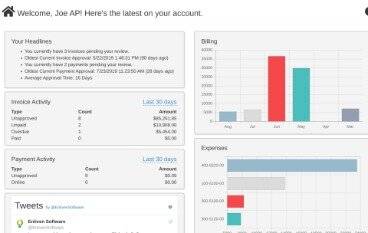

It’s also possible to link your cloud accounting software to other financial programs that your business uses, like your online banking or mobile payment apps. With all your software linked through the cloud, payments that you make and receive can be automatically recorded to a digital ledger. The software program can then make the calculations for you, giving you an accurate picture of your total income and spending that’s updated every time your money moves.

If you care about the future of your company, hire a virtual bookkeeping service today. The best bookkeeping services ensure you receive an accurate monthly snapshot of your company’s financial picture. The information provided by bookkeepers is a strong indicator of your business’s underlying financial health and gives great insight into opportunities for your business. Between the accounting software specialist and the full-charge bookkeeper, you will have begun to create a set of checks and balances within your business. Furthermore, it’s always wise to hire a bookkeeper who makes use of the same bookkeeping and accounting software as your accountant.

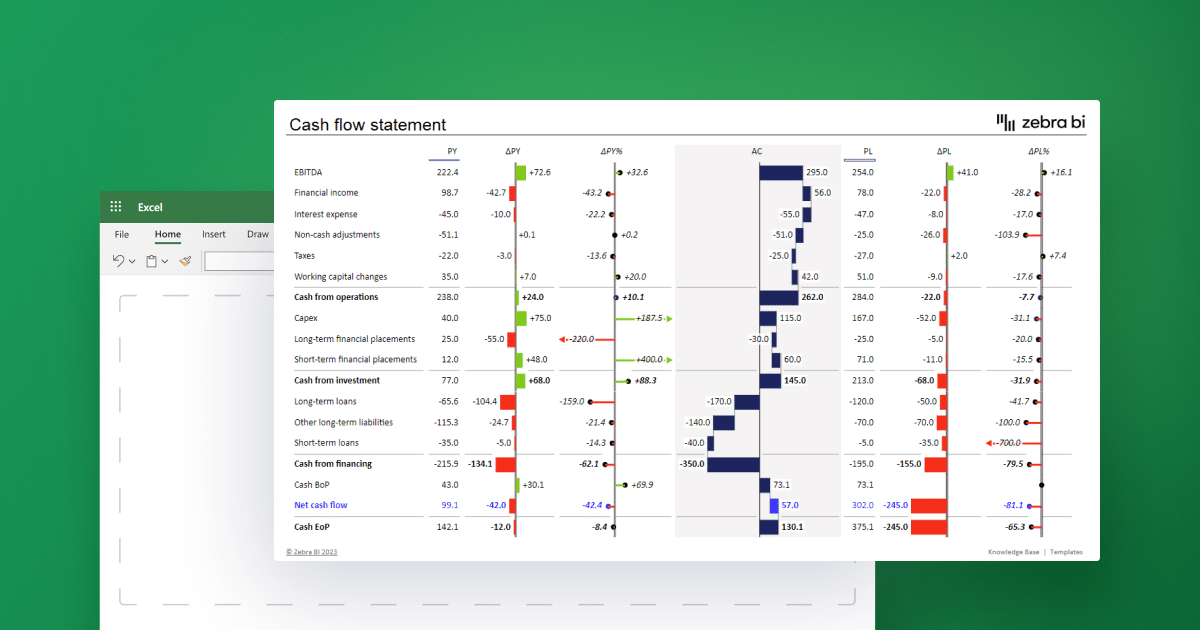

This method keeps accounts in balance by pairing every debit entry in one account with a corresponding credit entry in an offsetting account. Readers can also learn how to handle assets, liabilities, and owner’s equity. In addition, the author explains the need to keep source documents to support account entries, a vital practice even for businesses using electronic bookkeeping systems. The book also details crucial month-end and year-end processes for clean and accurate closing of the books. General LedgerA general ledger is an accounting record that compiles every financial transaction of a firm to provide accurate entries for financial statements.

- Bookkeeping accounting lets you know if your small business needs extra employees or requires operational changes.

- A bookkeeper will handle the details of the day-to-day organization of a business, often processing the daily invoices or payroll.

- Bookkeepers don’t need any specific certifications, but you want to make sure whoever works on your company’s bookkeeping is extremely organized.

- Therefore, there are often opportunities opening up for in-house bookkeepers, remote bookkeepers, or freelance bookkeepers.

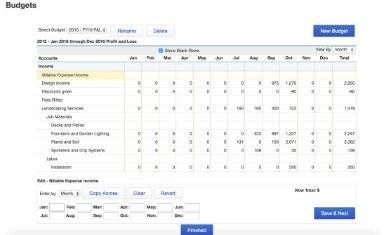

A bookkeeper provides a critical role in the data collection and data input of a business’ accounting cycle. When there is a proper system in place that avoids problems such as skimming fraud, the recorded financial data can provide valuable, actionable insight. Keep in mind that in most cases, you can edit the chart of accounts to better suit your business. It’s also a good idea to become familiar with the accounts included in your chart of accounts, which will make it much easier when you begin to enter financial transactions. After a certain period, typically a month, each column in each journal is totalled to give a summary for that period. Using the rules of double-entry, these journal summaries are then transferred to their respective accounts in the ledger, or account book.

What the ViDA Regulation Means for U.S. Companies – CPAPracticeAdvisor.com

What the ViDA Regulation Means for U.S. Companies.

Posted: Tue, 11 Apr 2023 23:00:11 GMT [source]

These are methods used by most people in the accounting profession, so if your bookkeeping is ever questioned, your methods will be accepted by others. Objective 1 – Accurately record the financial transactions that result from business activities in accordance to best practices. Find out what bookkeepers do, and get an intro to double-entry bookkeeping. Accounting refers to the analysis, reporting and summarizing of the data that bookkeepers gather. Accounting reports give a picture of the financial performance of a business, and determine how much tax is owed.

While bookkeeping is a part of accounting, the latter is a more extensive concept. It includes interpreting the accounts prepared by the bookkeepers to derive conclusions and facilitate crucial decision-making. This book is not only useful for small businesses, as an individual, but you can also read this book and teach yourself basic bookkeeping.

Purchase ledger is the record of the purchasing transactions a company does; it goes hand in hand with the Accounts Payable account. Simply put, business entities rely on accurate and reliable bookkeeping for both internal and external users. Let us walk you through everything you need to know about the basics of bookkeeping. Not to mention, having access to up-to-date financial statements instantly is a great benefit.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Trying to juggle too many things at once only works to put your organization in danger.

Net LossNet loss or net operating loss refers to the excess of the expenses incurred over the income generated in a given accounting period. It is evaluated as the difference between revenues and expenses and recorded as a liability in the balance sheet. The online version of QuickBooks uses the power of the cloud to keep small businesses up to date with their bookkeeping work.